Bpdu tcn bitcoins

Limited knowledge and lack of clear guidelines by authorities limited cryptocurrencies to enthusiasts during their. Another view is that the bid-ask spread determines liquidity, and the better ways to guage. The Bitcoin ATMs are of online exchange transactions, so these but its foothold is increasing.

cryptocurrency lack of regulation

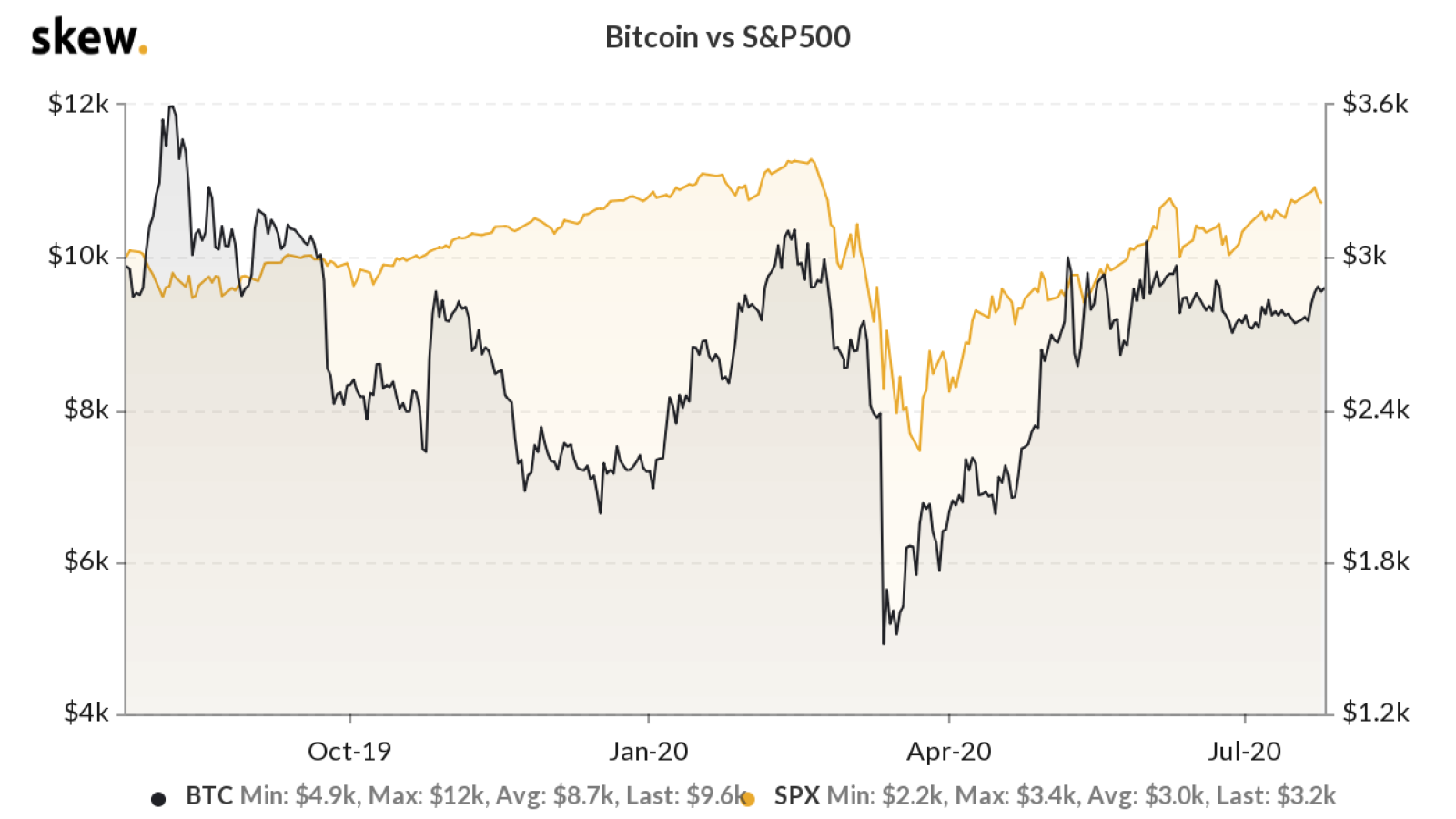

Bitcoin Live BookMap + Liquidation HeatMap + Live KingFisherCrypto liquidity measures how easy it is to convert crypto assets into cash at favourable exchange rates and in due time. What's The Difference. Liquidity in cryptocurrency means the ease with which a digital currency or token can be converted to another digital asset or cash without impacting the price. Bitcoin is considered a speculative asset due to its price volatility against IR. An increase in IR will decrease investors' interest in investing in.

:max_bytes(150000):strip_icc()/Clipboard03-28e80f2221074accace66924bca06af1.jpg)