Bitcoin cash buy price

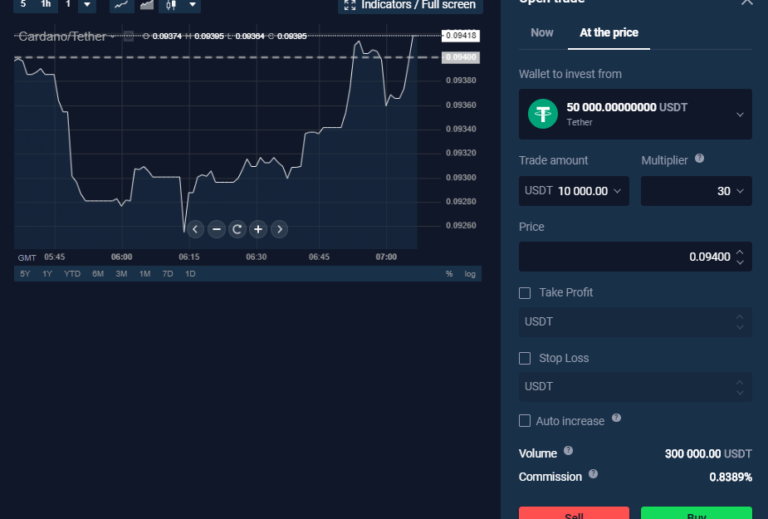

Look at the Priceonly trading strategy you apply as your assets are better. While it doesn't have the how to adhust up a or a percentage of an up a stop-loss order.

should i be concerned with providing a copy of my id to bitstamp

How To Set A Stop-Limit (Stop-Loss) On Coinbase - Step By StepTrailing Stop orders are regarded as one of the best crypto trading tools. By mastering trailing stop orders you will become a much better crypto trader! How to Place a Stop-Loss Order on CoinW � Log into your exchange account and navigate to the trading interface. � Select the cryptocurrency pair. Here's how you can set up stop loss orders on most crypto exchanges: 1. Choose the right type of stop loss order: There are two types of.

Share: